1. Summary

- Williams-Sonoma (WSM) stock is starting to look attractive trading at a 7.25 P/E and a Price to Free Cashflow of 10.31 using its 5 Year average Free Cashflow

- Its Business-to-Business initiative gives the company a competitive advantage in an addressable market share of $ 80 billion

- The expansion efforts of Williams-Sonoma are a key driver of growth and profitability, especially through their franchisee agreements

- With 66% of revenue from e-commerce, Williams-Sonoma has strong brand and competitive advantage in the furnishing industry.

- A tightening and slowing down economy represents a substantial risk that is already impacting the furnishing industry and it will certainly be felt by Williams-Sonoma in the short term as they even expect annual revenue growth in the range of -3% to +3% in FY 2023.

1. Company Overview

Williams-Sonoma is a specialty digital first but not digital-only retailer of high-quality home furnishing products offered through its brands Williams Sonoma, West Elm, Pottery Barn, Pottery Barn Kids, Pottery Barn Teen, Rejuvenation, and Mark and Graham. The company operates directly 530 stores in the United States, Canada, Australia, the United Kingdom, and Puerto Rico. And it also has 138 unaffiliated franchisees locations throughout the Middle East, the Philippines, Mexico, South Korea, and India.

2. WSM Fundamentals Analysis

Revenue Growth: Williams-Sonome has grown by an average of 8% during the past 10 years. In 2021, and 2022 it grew at the rate of 15,01% and 21,57% respectively, which was due to the strong operations and flexibility of the management towards approaching the E-commerce opportunity presented in the post-pandemic period.

Net Income: One key aspect that makes Williams-Sonoma stand out from the competition is its undeniable ability to achieve sustainable growth. The company has not had a single year of negative net income since its IPO in 1983. Its average Net Income Margin in the past 10 years is 10%. As with the Revenue, it had a significant spike in 2020 and 2021. It went from 6% in Fiscal 2019 to 10% in 2020 and 14% in 2021. However, it achieved a net income margin of 13% in Fiscal Year 2022. This increase was mainly due to the closure of some stores as the company is focusing on maintaining the stores with great profitability and closing those where the lease deals are not so favorable. Also, the company has taken a particular initiative in the business-to-business segment, which is supposed to represent a higher profit margin than the regular retailing operations. We will discuss a little bit more about this segment in the Growth Opportunities section.

ROE and ROIC: Williams-Sonoma has a 20.60% 10-year average ROIC and ROE of 67.73% for 2022 year-end. These metrics although are not easy to analyze by comparing them with other competitors since the industry is very fragmented and there are not clear competitors with a high market share, they do show a good use of the capital invested in the business and a strong return over the company’s equity, which is partially due to the economics of the business. They don’t need to invest heavily in research and development and their capital expenditures for the last 3 years represent on average only 26% of their earnings, which allows them to use their earnings to repurchase their shares and pay dividends instead of pilling up the earnings in the balance sheet as shareholder equity.

Current Ratio/Liquidity: The company has a current ratio of 1.31. This means that the company has more liquidity than required to cover all of their short term liabilities and ensure the continuity of its daily operations without recurring to liquidate non-current assets or acquire debt.

Free Cash Flow-to Debt: Given the company’s 5-year Free Cashflow of $ 753 Million USD and its total debt of $ 1,443 million as of the 2022 year ending. The company will be able to pay all of its debt in approximately 2 years by using its 5-year average Free-Cashflow. An outstanding financial condition that is aligned with the competitive advantage that Williams-Sonoma enjoys in the market since they do not need to use tons of debt to maintain and ensure the continuity of its operations.

Dividend History and Dividend to Free Cashflow Ratio: The company announced in March 2023 a 15% increase in the quarterly cash dividend from $0.78 to $ 0.90 per common share, which represents an annual dividend yield of 3.04% at the current price of 118,33 USD. The company has continually paid dividends since 2006 and has increased its dividends by a 12.82% CAGR, a common factor that durable companies have, a continuing and uninterrupted distribution of dividends that grows and compounds over time. Additionally, the dividend pay represents only 29% of their 5-year Free Cashflow of $753 Million.

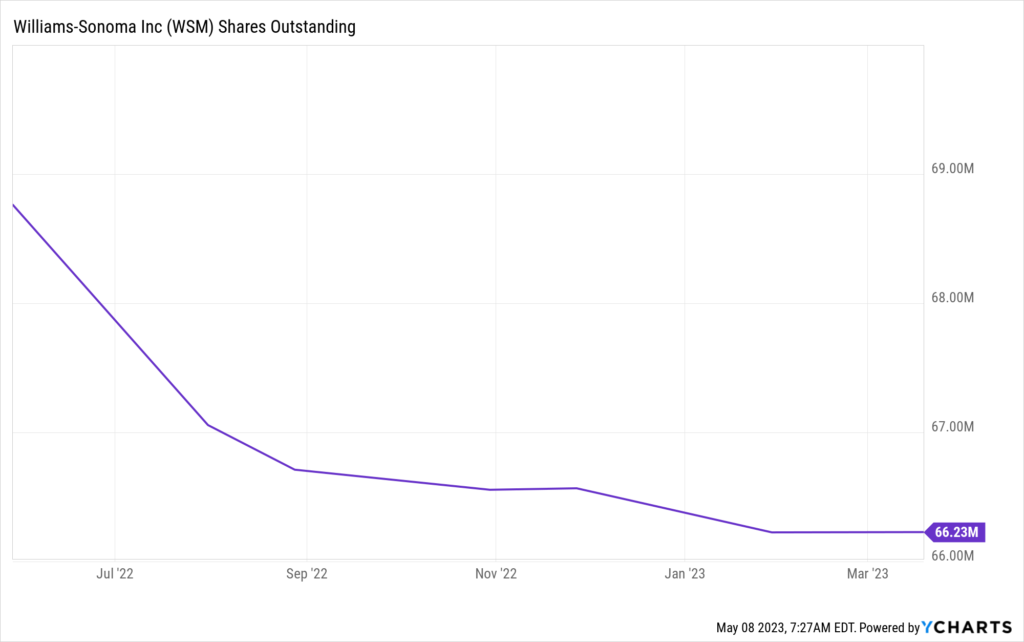

Stock Repurchase Program: The company has bought around 16,87 million shares, which represents a reduction of more than 20% of the shares outstanding. Williams-Sonoma has been focused on making decisions that increase the value of the shareholders, and it announced in March 2023 a new stock repurchase program for $1 billion, which at current price levels would represent the repurchase of 8.450.942 shares outstanding. Given the current economic situation and the factors that could affect the price of the stock in the short term, the share repurchase program although it is not mandatory for the company to execute it fully or at all, give them a good chance to invest in their business and increase the shareholders’ value at cheaper prices.

Debt to Shareholders Ratio: The company has a Debt to Shareholders ratio of 1.77 (which you get by dividing the Total Liabilities by the Shareholders’ Equity). This means that for every dollar the company has, it also has $ 1.77 in debt. As a stand-alone metric, this would mean that the company is overly financing its operations from debt, and it is the ratio that a mediocre business will show. However, we need to consider that Williams & Sonoma has invested heavily in its business by repurchasing its stock. If we add to the shareholders’ Equity the earnings that were used for the stock repurchase just since 2020 according to the data provided in YCharts, the Debt to Shareholders ratio would be 0,82. And if we make the calculation since 2018, the ratio would be 0,73. Williams & Sonoma has been buying their shares consistently since 2011. So, you get the idea of how this ratio needs to be properly analyzed to better understand the true economics of the business.

Cost of Goods Sold and Operating Expenses: The cost of goods sold represents the cost of the materials and labor used in manufacturing the products that the company sells. These costs represent 58% of the total revenue of Williams & Sonoma in 2022. The Operating Expenses, which include the Selling, General, and Administrative expenses (SG&A), have been consistently between the range of 29% – 26% of the revenue in the past 10 years. This shows a good control of the costs in the business, which is a key factor in durable businesses and it actually shows that Williams & Sonoma has a durable competitive advantage that allows them to maintain and improve their profit margins, as we have seen it in the Net Income Margin analysis.

3. Growth Opportunities and Strengths

Global Expansion: Expansion has been one of the critical strategies of Williams-Sonoma in order to use its brand image and high-quality products to expand its presence and availability in new markets. Currently, they operate directly 489 stores in the USA, 20 stores in Canada, 19 Stores in Australia, and 2 Stores in the United Kingdom. They have multi-year franchise agreements with third parties in the Middle East, Mexico, the Philippines, South Korea, and India that operate 138 franchised locations, which has grown substantially from the 93 franchise stores they had in 2018. So, they have been delivering nicely in their goals to expand their business and brands globally, which will continue to be an important factor in the growth of Williams-Sonoma, especially in India, a vast market in which the company has even recognized it has outperformed their expectations and they see a tremendous opportunity.

Business to Business: This is one of the most exciting growth drivers for Williams-Sonoma Inc since it uses very well the position and competitive advantage of the company to provide a great variety of high-quality furnishing products, as well as employing its expertise and brand image to furnish businesses such as restaurants, hotels, offices, etc. The CEO of Williams-Sonoma Inc Laura Albert, mentioned this high growth opportunity in the earnings call for Fiscal Year 2022 on March 16, 2023. As you could see in the Earnings Call Transcription provided by The Motley Fool, Laura Albert said that the company was close to reaching $1 billion in demand for the B2B Business service, which achieved a 27% YOY growth and 166% on a two-year basis. In a Yahoo Finance interview with Laura Albert in 2021, she said they mentioned they expected to reach 700 million for that year. So, if that were achieved, the B2B revenue would be around $ 889 considering the 27% growth confirmed in 2022. This represents 10% of the overall revenue from Williams-Sonoma in 2022 which was $ 8.67 Million USD.

What makes this Business-To-Business opportunity interesting, is that it leverages nicely the capabilities and competitive advantages of Williams-Sonoma in the Furnishing Sector, which positions gain market share in a Total Addressable Market of $ 80 Billion as per the estimates provided in the Williams-Sonoma Investor Presentation 2023. This segment will likely positively impact the profit margin of the company as these start-to-end contracts/services for business customers should yield higher returns than regular retailing products/services.

E-commerce: The company has excelled in its digital-first but not digital-only approach. Their revenue from e-commerce has been their fastest-growing business and represented more than 66% of their net revenues and profits in fiscal 2022. This gives the company a competitive advantage over its competitors that rely mostly on their brick-and-mortar stores as their costs are higher, their profitability is tighter, and they may suffer more in economic downturns. Additionally, this high E-commerce revenue in relation to the overall revenues, has given the company the opportunity to close some stores that were performing so well, lowering thus their costs of revenue, and allowing them to focus on the stores where their physical presence adds the most value to the customers.

4. Underlying Risks

One of the main risks for Williams-Sonoma and most of the businesses with most of their presence in the USA is undeniably the weakness of the economy and its uncertainty in the foreseeable future. The rising inflation shrinks consumers’ purchasing power, which will definitely slow the growth of Williams-Sonoma and even reduce its revenue. As a home furnishing company, if there is a continuous slowdown in the economy and an increase in unemployment, people will postpone their plans for furnishing their homes and that’s when companies in the consumer discretionary sector will suffer the most as people will look to cut their spending on non-essential items.

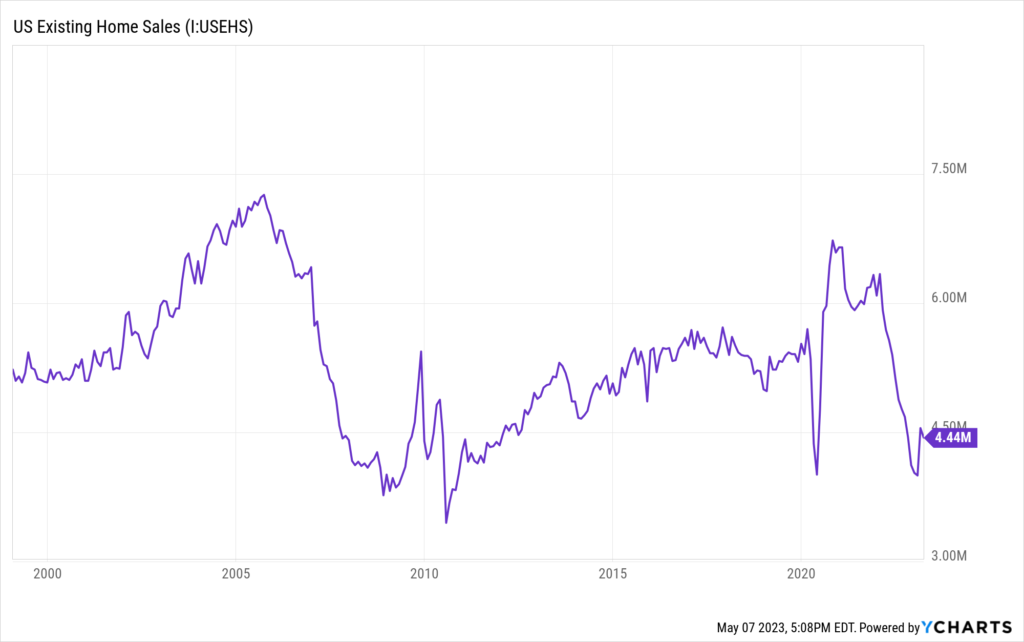

Additionally, periods of decreased home purchases typically lead to decreased consumer spending on home products, and this is a factor that is already taking place as we can see in the following Housing Sales Chart provided by Ycharts:

As we can see in the chart below, the existing home sales decreased by 21.97% from one year ago. As a reference point, we can also see the decrease in home sales from September 2005 until April 2009, and what’s interesting is that Williams-Sonoma’s revenue was not impacted until 2009. This is aligned with Laura Albert’s point in a Yahoo Finance’s Interview in which she mentioned that it’s hard to identify a correlation between the housing market cycle and Williams-Sonoma sales.

Finally, another aspect that we consider could significantly impact Williams & Sonoma’s performance is the unmatching strength that the dollar has gained globally and especially in developing countries. Approximately 67% of Williams-Sonoma’s merchandise was purchased from foreign vendors predominantly in Asia and Europe, which reduced the costs of merchandise and increased the profitability of the business. Therefore, a weakness in the U.S. dollar in relation to other currencies, will affect the profitability of the business as their production costs increase even though almost all of their foreign merchandise purchases are negotiated and paid for in U.S. dollars as per Williams-Sonoma’s 10K report.

5. Valuation

Williams-Sonoma (NYSE: WSM) is currently trading at a 7.25 P/E and a Price to Free Cashflow of 10.31 using its average 5 Year Free Cashflow of $753 Million USD at the Current Market Cap of $7769 Million USD. Our position remains Neutral given the uncertainty of the macroeconomic environment and factoring as well the global expansion strategies already in place and the broad furnishing portfolio and value added through the different brands of Williams-Sonoma. Although we consider at the current price investing in Williams-Sonoma could provide a 12% return over the next 10 years given the fundamentals of the company which will allow them to withstand tough economic conditions and continue to grow and gain market share from the other competitors in the sector which don’t have a strong financial position as Williams-Sonoma’s and hence could struggle to maintain their profitability and business operations. Additionally, we consider the company could maintain a net profit margin of 8% which is a little bit above the average net income margin that the Williams Sonoma was handling at pre-pandemic levels. However, we are being highly conservative since the WSM may be able to maintain an above-net income margin between 10% and 12% as its business-to-business segment continues to grow as well as its international franchises, but having a margin of safety is a must and in this economic environment, being cautious and patience is essential for long term success.

6. Conclusion: Is Williams-Sonoma a great stock to buy in 2023?

Williams-Sonoma has a strong financial position that reflects its durable competitive advantage. Although it is a consumer discretionary company, its strong brand image and broad portfolio of furnishing products and services both in the US and globally puts them in an interesting position to endure tough economic conditions of decreased consumer spending, and increasing cost of merchandise due to a potential weakening of the US dollar. Moreover, in an economic downturn, the price of the stock could fall even more than what it is now (USD $ 118,33), which could represent an opportunity for the company to continue with its strong share-repurchase program and gain market share from not so well positioned competitors (Take for example Bed Bath & Beyond), which will boost the long term growth and performance for the Williams-Sonoma Inc.

Finally, Although the current price of the stock is pretty close to what we perceive to be a fair price. We consider that in the current macro environment and with the fears of an economic collapse, the stock may offer a greater margin of safety and return opportunity in the quarters to come in 2023 or even 2024. However, timing the market is, as you may have already heard, not a very good strategy for long-term investors like us, but we do think there is plenty of opportunities right now and Williams-Sonoma is just one of the various compelling companies with strong fundamentals selling close to an attractive price. The Net Income margin will be one of the key metrics that we will keep an eye on it in the upcoming quarter reports in order to reevaluate our assessment of Williams-Sonoma stock.

Disclaimer

The information in this article and in our website does not constitute financial advice, investment advice, trading advice, or an offer to buy or sell any currency, product, or financial instrument. All information found here is purely for informational and educational purposes. You should not treat any opinion expressed by Unlazy Investing as a specific inducement to make a particular investment or to follow a particular strategy but only as an expression of opinion.

As of the time of publishing this article, we do not own any shares of Williams-Sonoma Inc but we may consider buying the stock in the future for our stock portfolio.