1. Company Overview

Ulta Beauty was founded in 1990 with the idea to disrupt the beauty industry by offering both mass and prestige products, and it is now the largest specialty beauty retailer in the United States and the premier beauty destination for cosmetics, fragrances, skincare products, hair care products, and salon services. Ulta Beauty appeals to a wide customer segment, for which they have an assortment of more than 25,000 products from more than 600 well-established and emerging beauty brands for different categories and price points. Ulta operates only in the US, with 1,362 stores predominantly located in off-mall locations.

2. Financial Performance

Second Quarter FY 2023

- Comparable sales increased 8% compared to an increase of 14.4% in Q2 2022. Although the growth was slower than the previous quarter, the increase was driven mainly by a 9% increase in transactions and a 1.0% decrease in average ticket.

- Net sales increased 10% to 2.5 billion, compared to the 2.29 billion reported in Q2 FY 2022.

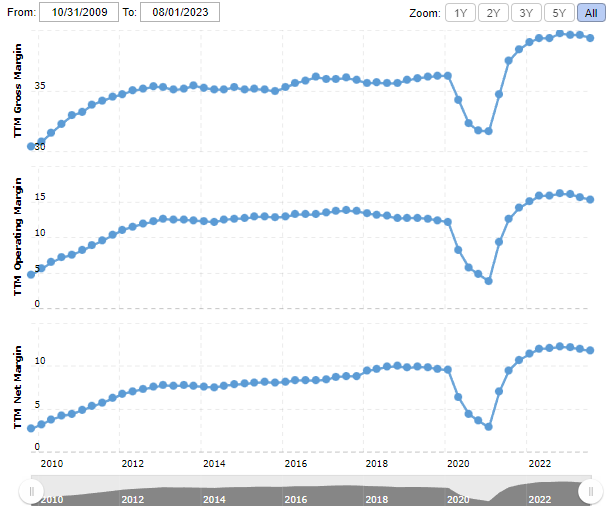

- Gross profit increased 7.1% to $993.6 million as a percentage of net sales. Although it decreased slightly by 110 basis points to 39.3%, it remains well above its 10-year average of 36%. This decrease was attributed mainly to lower merchandise margins, higher inventory shrinkage, and higher supply chain costs.

- SG&A as a percentage of net sales was 23,70% (current), relatively similar to the 23,26% for the same quarter in FY 2022. SG&A is expected to increase as a percentage of net sales as some of the company’s initiatives for operational efficiency are being pushed to Q3 and Q4 in FY 2023.

- Operating margin decreased by 1.5% to 15.5% as the company is seeing a normalization in growth after the pandemic and an increase in promotional activity as well.

- Diluted EPS increased 5.6% to $6.02, beating expectations of $5.87.

3. Ulta Beauty’s Growth Journey

Looking at the bigger picture is useful for getting an insight into the company’s trajectory and where it may be headed in the years to come (just as a hint, since the future may not resemble the past performance). And we can see Ulta is a stellar performer; from 2008 to 2022, Ulta’s revenue has grown at a 17.77% CAGR, and its free cash flow has grown at a 20% CAGR. Its net income improved gradually from 4.41% in 2012 up to 12.17% in 2022. Though net income is expected to return slightly above the 9.54% reported in 2019 before the pandemic period.

It is also worth noticing that the revenue for Ulta Beauty did not decrease during the US financial crisis of 2008-2009; indeed, Ulta’s revenue increased by 12.7% from 2008 to 2009, showing a strong performance in a sector that could be considered within both the consumer staples and nondiscretionary discretionary categories, which is why the industry as a whole tends to be more resilient than others as it carries out products of day-to-day use.

Ulta Beauty’s continuous growth has been reflected in the stock’s performance as well. Since Ulta Beauty’s IPO on October 26, 2007. The company’s stock price has increased more than 10 times, going from $32 per share to the current $408 per share price. What is even more interesting is that even though Ulta Beauty performed proficiently during 2007–2009, In 2009 the stock had fell 86.25% to $4.40 per share from its IPO stock price. This is just a side note, but worth mentioning one because it reflects how crazy the stock market could be. If you had bought the stock at that price, you would have now an impressive 91 bagger, 91 times your money! Anyway, let’s keep going.

Part of such stellar performance was due to the strong and well-differentiated value proposition of Ulta, which consists of offering both mass and prestige products at the same place, as the company calls it, to be a one-stop shop, and this is still part of their competitive advantage. This ability to attract luxury, mass, and emerging brands allowed the company to strengthen its one-stop shopping value proposition, increase the number of products offered from 21,000 in 2008 to 25,000 in 2022, and expand the number of stores from 249 in 2008 to 1,362 that Ulta currently operates.

The key factors driving the growth of Ulta Beauty are its clear and differentiated value proposition. This is reflected in Ulta Beauty’s loyalty program, which went from 6 million in 2008 to over 41 million in 2023. The company’s ability and approach towards not relying on significant debt to grow the business, is worth noticing as it reflects the operational strategy of a well-run and stable business, which they could easily afford due to Ulta Beauty’s constant and increasing stream of cash flow while maintaining a strong financial position. Moreover, Ulta Beauty’s average ROIC since 2009 to 2022 has been 22,20%, and it shows signs of a durable competitive advantage.

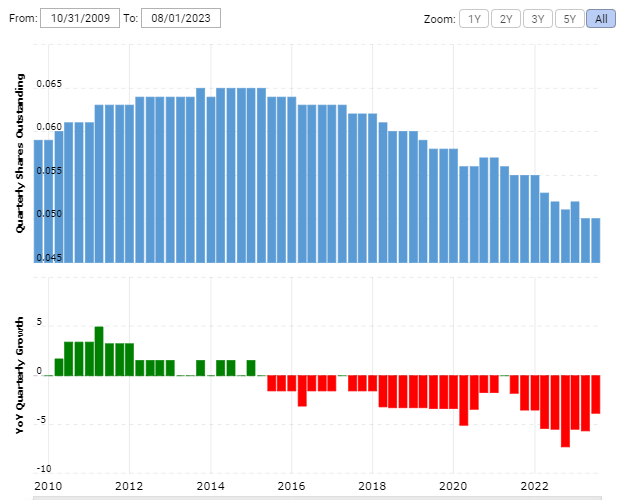

Finally, Ulta Beauty has been consistently buying back its shares outstanding Since 2015 to 2023, the company has reduced its shares outstanding by 20% to 49.8 million. However, there has not been a clear strategic timing for the share repurchase; for example, they did increased sligthly the amount of shares repurchased in 2020, when the stock was down significantly, but they also increased the pace of the shares repurchased in 2023, when the stock price was at its highest point. So, altough it’s good that they are betting on the company as the stock is not too expensive, it is better when the management has the ability and record of buying aggressively when the stock is significantly undervalued, and to decreased or stop the repurchases when the stock price is overvalued.

4. Growth Opportunities and Competitive Advantage

Ulta Beauty’s long-term plan for its store expansion is to have over 1,500 to 1,700 stores, which is an increase in its current store fleet of approximately 25%. So while Ulta Beauty’s revenue growth rate won’t be double digits as it has been in the past, there is still some room for growth in U.S. stores. By FY 2023, the company expects to open 25 to 30 new stores and renovate or relocate 20 to 30 stores this year.

Along with Ulta Beauty’s expansion strategy, the company is partnering with Target to extend the reach of Ulta Beauty to new customers, for which there are now 421 Ulta Beauty shops at Target after having opened 62 shops during Q2 FY 2023. Ulta Beauty expects to have around 800 target locations in the long term. This partnership will give Ulta Beauty more exposure and presence in the market. Although there are some concerns that this partnership will cannibalize Ulta Beauty’s store sales since its customers could go and buy at Ulta Beauty shop at Target instead of going to an Ulta Beauty store, we think the impact would not be significant since the assortment and variety of products at Target are way smaller than those offered at Ulta Beauty stores. So, this partnership could help Ulta Beauty attract more customers to its stores and its one-stop shopping value proposition.

Additionally, attracting customers is not a challenge for Ulta Beauty; the company has a sizable loyal customer program with 41 million active members, 9% higher than in the first quarter of FY 2022. The number of members in the “Ultamate Loyalty Program” has grown at a CAGR of 14.71% from 2008 to 2023, showing a stellar performance in Ulta Beauty’s ability to attract and retain customers. Moreover, 95% of Ulta Beauty’s sales come from its loyalty program members, which positions Ulta Beauty strongly to drive more recurring revenue and continue to increase its market share, which is estimated to be 9% in the beauty product industry and 1% in the salon services industry, according to forecasted Euromonitor International and IBIS World Inc. industry data provided for 2022.

5. Ulta’s Competitors

The US beauty industry has many players who compete with Ulta Beauty for prestige and mass products; these include traditional department stores like Macy’s or Nordstrom, specialty stores like Sephora, grocery stores, drug stores, mass merchandisers, and online retailers like Amazon.

Ulta Beauty’s Main Competitor: Sephora

Although there is no clear data in terms of revenue from Sephora, Ulta Beauty’s main competitor, which is a luxury beauty retailer from Louis Vuitton (LVMH) that reports revenue jointly with other businesses of LVMH, According to Forbes Sephora’s store count in the US for 2021 would be around 712; there is no clear data provided by LVMH for Sephora’s stores. But we do know that Sephora is expanding in the US through its partnership with KOHL’s, which has around 600 Sephora stores at Kohl’s stores, and the company is expecting to have 850 stores in 2023 and bring Sephora shops to all of KOHL’s 1,100 locations in the long term. However, a clear distinction between Sephora and Ulta Beauty is that Sephora focuses on providing luxury beauty products, while Ulta Beauty offers prestige and mass beauty products, thus appealing to a much broader market segment.

Ultamate Rewards vs Beauty Insider Loyalty Program

In terms of customer loyalty, Sephora has a smaller member base on its Beauty Insider program, with around 31 million members in the U.S., according to Retail Dive. That is 10 million less members than Ulta Beauty’s loyalty program “Ultamate Rewards”. And though Sephora’s “Beauty Insider” loyalty program was launched in 2007, it was much later than Ulta Beauty’s loyalty program, initiated in 1996. There are two clear reasons why Ulta Beauty’s loyalty program has more members than Sephora’s program. The first reason is the overall extra value given to the customer that Ulta Beauty offers; for both programs, each dollar spent accounts for 1 point in the loyalty program, which can then be redeemed for selected products.

However, in the Ulta Beauty’s “Ultamate Rewards Program“, customers with 1,000 points can get $50 off their purchases, and with 2,000 points, they get $125 off. Now, on Sephora’s “Beauty Insider Program“, for 500 points, customers get $10 off their purchases, and for 2,500 points, customers get $100 off their purchases. So, in the Ultimate Rewards Program, its customers get $25 more than on Sephora’s Insider Beauty program with 500 points less as well (if they were to redeem 2,000 points, for this example), which is substantially less than the value (in terms of dollar savings) provided on Ulta Beauty’s Loyalty Program. Finally, it is important to notice that Sephora’s target customer segment is different and more narrowed than Ulta Beauty’s and that some differences in their loyalty programs offer great value to their customers. However, we focused mainly on the discount or value received per dollar spent, as it is the most noticeable difference and has the strongest appeal when it comes to attracting and retaining customers.

The second reason for Ulta Beauty’s loyalty program’s greater recognition is that Ulta Beauty’s value proposition of being the preferred one-stop retailer allows the company to attract a broader market segment for its prestige and mass products, and that gives a strong competitive advantage to the company as it provides the best value to customers who are both price sensitive and open to purchasing more expensive or prestige products from time to time. So, in tough economic conditions, cost-advantaged businesses like Ulta Beauty tend to get ahead of their competitors as customers get more savvy and look for places where they can save some dollars while getting a comfortable shopping experience.

6. Ulta Beauty Valuation

At the current price of $415,83 per share, the stock is selling at a 16.69 PE and a 17.50 price to free cash flow. The stock is not expensive by any means considering its ability to grow, attract, and retain customers by providing the best value option through its loyalty program while maintaining an average ROIC of 25% in the last 5 years and 22,20% since 2008.

Although it is clear that the company is not going to grow at high double digits forever, Ulta’s growth is expected to decline to high single digits (9–8%) in the short term, as they are still on their way to opening around 300 to 400 new stores to get to their target store count of 1,500–1,700 stores. So, when it comes to determining the prospects for Ulta Beauty, first of all, a P/E of approximately 16, for a company in which there is a reasonably good certainty of its future cash flows given Ulta’s positioning in the market, is a rather fair P/E considering the growth expectations and the great profitability in terms of return on invested capital that Ulta can generate. So, we consider that at the current price, Ulta Beauty could double its earnings and (therefore) its stock price within a 7-year period, which is not bad at all (but not great either), and if the stock price continues to decline due to the uncertainty and pressure on the economy, Ulta Beauty could be a great investment opportunity.

7. Key Metrics to Watch Out

For Ulta Beauty to double its earnings within 7 years, the following business metrics will play a crucial role, and we will be looking for these metrics in the upcoming quarters.

The first thing is growth; we consider Ulta Beauty will be able to grow at an average rate of 7% in at least the next five years, and there could even be an upside as Ulta Beauty considers its international expansion as a growth strategy in the future (though it is not certain). In 2019, Ulta Beauty had plans to expand internationally with an initial launch in Canada, but due to the COVID-19 pandemic, the company decided to prioritize its growth and the improvement of its omnichannel capabilities in the U.S. and thus suspended the expansion to Canada. Therefore, as long as Ulta Beauty delivers on its strategy to open on average 30 new stores per year until reaching its target of 1,500–1,700 stores, it could sustain the company’s growth over the next 5 years at least.

The second aspect is the profit margin, which has improved over the years to the 12% reported in the last quarter but is expected to decrease slightly in the short term to around 10% as the company benefited from low promotional levels after the pandemic and also from increasing prices, which are now expected to normalize to 2019 levels. However, the investments in in-store shipping capabilities, e-commerce, and the benefit of the fixed store cost leverage will help Ulta Beauty’s profit margins in the long term.

The third aspect, and the one that drives Ulta Beauty’s competitive advantage, is its customer loyalty program. So, we will be watching to see if Ulta Beauty can keep growing its “Ultamate Rewards Program” from its current 41 million active members, who represent about 95% of Ulta Beauty’s overall sales. This value driver will position Ulta Beauty to continue to increase its market share (9% currently and up almost 3% since 2017), as this impressive customer engagement rate gives Ulta Beauty a great deal of insight into its customers’ shopping behaviors and preferences across its widest assortment of products and different price points, which we think is a great asset for the company and will compound Ulta’s ability to provide highly personalized offers, recommendations, and overall value to its customers.

Finally, the fourth key metric, along with a strong financial position, is Ulta Beauty’s (ROIC) capacity to compound its capital invested in opening new stores, improving customer engagement and comparable sales, and repurchasing its shares outstanding, while maintaining a ROIC above 22% (its average ROIC since 2009).

Disclaimer

The information in this article and on our website does not constitute financial advice, investment advice, trading advice, or an offer to buy or sell any currency, product, or financial instrument. All information found here is purely for informational and educational purposes. You should not treat any opinion expressed by Unlazy Investing as a specific inducement to make a particular investment or to follow a particular strategy, but only as an expression of opinion.