1. Crocs Company Overview

Crocs is a leading company in the casual footwear market for women, men, and children. Its shoes are sold in more than 85 countries through wholesale and direct-to-consumer channels. The Crocs brand was ranked the number two casual footwear brand amongst women and number three amongst men in a recent LEK study of footwear and apparel brand heat. Crocs products, including its iconic clogs, are recognized for their comfort, durability, and style. The company had a massive revenue growth of 66.88% and 53.70% in 2021 and 2022 respectively through its different operating segments such as the North American region, Asia Pacific, Europe, Middle East, Africa, and Latin America (EMEALA).

1. Crocs Fundamental Analysis

Retail and Distribution Channels: Crocs sells its products in more than 85 countries through wholesale and direct-to-consumer channels. The wholesale channels include domestic and international multi-brand retailers, mono-branded partner stores, e-tailers, and distributors. The Direct to Consumer channel includes company-operated e-commerce sites, third-party marketplaces, and company-operated retail and outlet stores.

Revenue Growth: Crocs had a spectacular growth of 66.88% and 53.70% in 2021 and 2022 respectively. This was mainly due to the change that the pandemic had in people’s lives in 2020 where people spent far too much time at their homes, which was a key driver for the comfortability value proposition of Crocs. Crocs’ 5-year average revenue growth is 30.51%, a significant change from its performance in the 5-year revenue growth average of -1.70% for the period before 2018. The main reason for such improvement in growth was the momentum achieved due to the pandemic as we mentioned previously, as well as the addition of HEYDUDE Brand revenues of $ 895.9 million as a result of the acquisition in 2022, and an increase in their average selling prices for the crocs brand which was enhanced by the notable improvement in Crocs brand recognition worldwide.

Net Income and SG&A: The net income for Crocs has variated similarly to their revenue growth. They had a 23%, 31%, and 15% net income for 2020, 2021, and 2022 respectively, which is higher than their 1%, 5%, and 10% net income margin in 2017,2018, and 2019, and the years before are honestly way less encouraging with a 5-year net income average of 1% since 2012 to 2016.

However, it is important to understand the key factors that played a significant role in the company’s profitability. So let’s see a quick overview of some of their improvement measures towards profitability since 2016.

2016: Crocs started to focus on improving the efficiency and effectiveness of their operations in 2016 through a shift from full-price retail to outlet stores. During the year ended December 31, 2016, they opened 50 outlet stores and closed 66 full-price stores. The SG&A costs as a percentage of revenue for the year were 49%.

2017: The company made a Cost Reduction Strategy that consisted of 4 key points. First, reducing the owned and operated store base, closing or transferring unproductive stores. Second, sell non-core markets and transfer the operations of those markets to distributors in which they sold stores in South Africa, Taiwan, the Middle East & Hongkong. Third, they planned to eliminate overhead as a result of reducing the store base. And fourth, employ more efficient processes resulting from the implementation of a global Enterprise Resource Planning software. The implementation of this strategic plan had the objective of reducing annual SG&A costs in the amount of $75 to $85 million. They achieved approximately $23 million of SG&A reductions while incurring approximately $10 million of costs to adjust their variable compensation plan. Crocs was able to reduce the company-operated retail stores in 2017 by 111 reducing thus the total store count to approximately 447 from 558. The SG&A costs as a percentage of revenue for the year were 48%.

2018: Crocs continued to improve its profitability through the implementation of its cost-reduction strategy. The company closed or transferred to distributors 68 stores in 2018, of which 61% were full-priced locations. Crocs also continued to with is focus on outlet stores, and for the year ended December 31, 2018, they represented 50% of Crocs’ store base, up from 41% at the end of 2016. The SG&A costs as a percentage of revenue for the year were 45%.

2019: Crocs closed or transferred to distributors 31 stores, from which, 48% were full-priced locations. This represents a total reduction of 16 company-operated retail stores. Since the implementation of the store reduction program early in 2017, the company closed in 2019 a total of 191 stores and reduced its total company-operated store count to 367 from 558 at the end of 2016. The SG&A costs as a percentage of revenue for the year were 40%.

2020 to 2022: In 2020, Crocs had 351 stores and ended up with 345 in the year ending December 31, 2022. There was no significant change in store closings. However, SG&A as a percentage of revenue went down from 37% in 2020 to 28% in 2022. Some of the key developments for the Improvements of SG&A were a reduction in the fixed cost base, as well as increasing pricing and fewer promotions, as well as decreasing discounts as the company increased its brand recognition globally and was able to leverage better its production capabilities and marketing strategy, which consisted and still consists of collaborating with celebrities to develop limited Crocs editions and keep the customers engaged with the brand and its new releases.

ROIC: Crocs’ 5-year average ROIC of 33.14% represents the company’s ability to generate profits over its capital employed. They have had great success in their marketing campaigns and their expansion efforts, allowing them to improve the value and recognition of the brand, and therefore being able to generate profits with lower costs.

Current Ratio/Liquidity: Crocs has a current ratio of 1.60. The company has plenty of liquidity to cover its short-term obligations without recurring to sell non-current assets and acquire or issue debt to ensure the continuation of its business operations.

Free Cashflow to-Total Debt: The company has a 5 Year average free cash flow of $412 million USD and its total debt is $2.59 Billion USD. Therefore, Crocs could pay all of its debt in approximately 9 years if its 5-year average free cash flow remains stable. We think the company’s liquidity will improve as they repay its debt from the HEYDUDE acquisition and use its distribution capabilities to grow the revenue from the HEYDUDE brand.

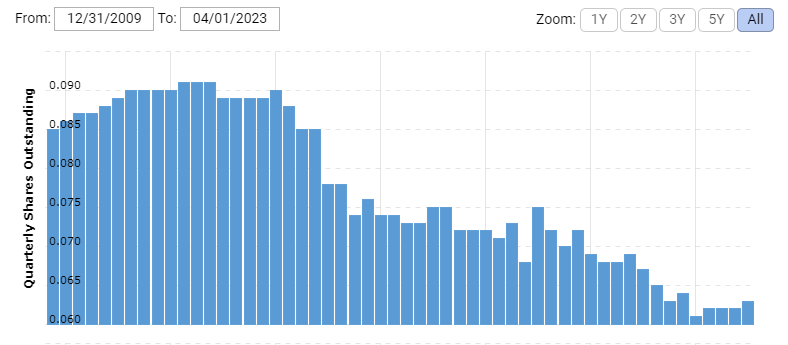

Stock Repurchase: Crocs currently as of December 31, 2022, has approximately $1.0 billion approved and available for share repurchase. However, the company suspended the share repurchase program due to the indebtedness acquired to finance the HEYDUDE acquisition, and they are prioritizing repayments of debt until their gross leverage is under 2.0x, which they estimate will happen by mid-2023.

Additionally, as you can see in the Shares Outstanding Chart above, the company has been buying its shares consistently. From 2010 to 2022 Crocs reduced its shares outstanding from 91 million to 62 million, which represents a total reduction of approximately 32%. Although it is not an impressive buyback trend, the company has shown confidence in its future outlook by investing in itself, and in the long term, these share buybacks could boost significantly the compounding of its earnings per share.

Debt to Shareholders Ratio: Crocs has a Debt to Shareholders Ratio of 3.17.This represents a significant debt risk for the company as it is over-leveraged due to the financing of the HEYDUDE brand acquisition, for which Crocs took a secured term Loan for $2.0 billion and borrowed $50.0 Million. Therefore, if any significant unexpected financial obligation or weakness in Crocs’ free cashflow takes place, the company may be unable to ensure the continuation of its operations or plans for growth since it may not be able to take on more debt or it will be more expensive to do so.

3. Strengths and Growth Opportunities

- Crocs’ value proposition of comfortable, fun, and stylish footwear positions the brand separately from most of the key players in the footwear market. So, although they compete with big brands like Nike, Adidas, and Skechers, just to name a few, Crocs customers are loyal to the brand and that gives Crocs a competitive advantage that was boosted due to the pandemic, but the company has offered since its early beginnings. Therefore, We don’t think of Crocs as a “FAD” as they have gained share in the customers’ minds and lifestyles.

- Crocs has an interesting geographical diversification. They operate in North America, Asia Pacific, and Emeala (Europe, Middle East, Africa, and Latin America) and their shoes are sold in more than 85 Countries. In 2022 the revenues for the Asia Pacific segment grew by 35%, the EMEALA segment revenue grew by 32%, and the North America segment revenue grew by 5.8%. Moreover, their Net income from Asia Pacific and Emeala represents 35% of the total Net income, and it seems reasonable for this margin to expand as they grow in promising markets such as Asia. So, we do see value in their global presence and what it means for their profitability and growth since it positions Crocs in a stronger position if there are any tough market conditions accentuated in specific countries, which the North American segment is experiencing in 2023.

- The Acquisition of HEYDUDE is an important opportunity for Crocs as they will be able to leverage their brand image and distribution network to expand the market and boost the growth of HEYDUDE products, which are aligned with Crocs’ value proposition of comfortability and simplistic style. Additionally, from an investment perspective, the HEYDUDE acquisition was an interesting deal. The company paid $2.5 billion for the company in 2022 and Heydude generated over $211 million in the year ended December 31, 2022, which represents a return on investment of 8.4%, not a bad deal, and it has a great potential for growth if Crocs achieves to position HEYDUDE in its international markets.

- The ability of Crocs to enter into new market segments such as the Sandals Segment is a noteworthy strenght and opportunity for Crocs to ensure its continuous growth globally since it reflects the company’s adaptability to leverage its brand and comfortability to take advantage of new trends and changes in the footwear industry.

4. Crocs Underlying Risks

- Liquidity and Financial Stability: The current economic environment in the U.S. adds to the uncertainty and risks for the growth and performance of Crocs since approximately 69% of its revenue comes from the United States. And given the indebtedness that the company had to incur to finance the acquisition of the HEYDUDE brand, the company may face short-term struggles that could prevent Crocs from capitalizing on business opportunities such as buying back shares if the price of its stock drops more than its intrinsic value or stopping its capital investments due to lack of resources.

- Sourcing: The production of Crocs is heavily concentrated in China and Vietnam. During the years ended December 31, 2022, 2021, and 2020, approximately 53%, 56% and 75%, respectively, of Crocs brand production was solely in Vietnam, it has decreased over the last years but still yet it exposes Crocs to a production breakdown if any unexpected risks take place with the production in Vietnam and China.

- Drastic Changes in the footwear market: The success of Crocs depends heavily inon the value of the brand and the company must do a consistent and outstanding marketing effort to remain relevant for the customers in an industry where trends and style changes happen constantly. Therefore, any damage to the reputation of the brand could impact heavily Crocs’ performance and growth across the globe.

- Competition: Although Crocs’ iconic clogs and products are well differentiated in the market. The company competes indirectly with strong brands in the footwear market such as Nike, Adidas, Sketchers, and Deckers Outdoor Corporation just to name a few. And these brands have greater financial resources, stronger brand recognition, longer-standing relationships with wholesalers, and distribution capabilities that could be employed to compete directly with Crocs and take away its market share. We consider competition is a risk for almost any company but the footwear market is extremely competitive and it could impact greater Crocs if its financial position stumbles and it can’t keep up with the level of innovation, promotion, and overall marketing campaigns of its competitors.

5. Crocs Stock Valuation

Crocs (NASDAQ: CROX) is trading at an interesting price of $108,20 USD with a P/E of 10,96 at the time of writing this article. With an expected double-digit growth between 11% and 14% compared to 2022, the expected adjusted operating margin is between 26% and 27%. However, given the uncertainty of the macroeconomic environment and the fact that institutional ownership in Crocs Shares outstanding is approximately 91%, the stock could see a significant fluctuation of its price if the fears of a recession in the U.S increases and there is a pullback from hedge funds, mutual funds, and private equity funds, which could create a more interesting opportunity to buy Crocs Shares at a lower price and with a higher Margin of Safety.

Therefore, we consider at current prices Crocs is fairly valued considering its growth opportunities and strengths. So, given our conservative investment approach, we will start to consider Crocs shares when its prices drop below the range of $100 – $90 USD per share as we would like to have a greater margin of safety and required rate of return that could ensure the return of investing in Crocs given the current macroeconomic environment.

6. Conclusion:

Crocs had a great performance over the last 5 years as their strategic actions have improved the profitability of the business and their brand recognition and reputation globally. Its recent acquisition of HEYDUDE has paid well for the company and its potential contribution to Crocs growth is notable. The company has an interesting geographical diversification and with the HEYDUDE brand acquisition, the company its expanding its product portfolio which is a key factor when it comes to ensure the sustainability of the company as it increases their revenue sources and balance their product risks.

We are interested in seeing how Crocs’ profitability plays out in the quarters to come in 2023 as they face a decrease in its revenue growth from the North America Region, and if they achieve to maintain its profitability and growth globally, we will consider investing in Crocs as we believe it has a strong brand image and reputation that is still being enforced internationally and it could leverage its competitive advantage to position itself as a top player in the industry of comfortable and stylish footwear internationally.

Disclaimer:

The information in this article and in our website does not constitute financial advice, investment advice, trading advice, or an offer to buy or sell any currency, product, or financial instrument. All information found here is purely for informational and educational purposes. You should not treat any opinion expressed by Unlazy Investing as a specific inducement to make a particular investment or to follow a particular strategy but only as an expression of opinion.

As of the time of publishing this article, we do not own any shares of Crocs (NASDAQ: CROX) but we may consider buying the stock in the future for our stock portfolio.