1. Summary

- La-Z-Boy has increased its revenue by a compound rate of 6% within the last 10 years and carries low debt on its balance sheet, enabling the company to endure a potential sustained economic decline.

- The mix of wholesale and retail operations provide a nice balance for the company while they continue to execute their retail penetration strategy, which is aims to provide a end-to-end service to its customers and increase the company’s overall profitability.

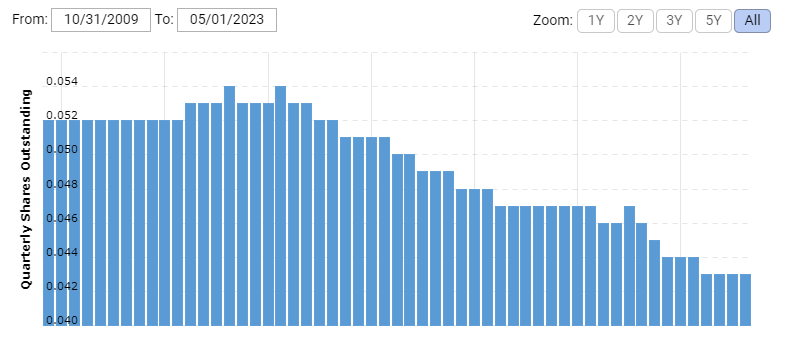

- La-Z-Boy has decreased its shares outstanding by 20.37% to 43 Million in the last ten years and it will be focusing about 50% of its operating Cash Flow in growing the business and return 50% to shareholders over the Long-Term through share repurchases and dividends.

- Its retail expansion strategy could represent a burden for the company as it will increase the fixed costs for the company and the revenue from this new stores could drag down the profitability and financial stability of the company in the short term.

2. La-Z-Boy Company Overview

Founded in 1927 with the invention of the first recliner chair, La-Z-Boy (Nyse : LZB) is the world’s largest maker of reclining chairs and the United States’ second-largest manufacturer of residential furniture. LZB has a global network of 348 La-Z-Boy furniture galleries stores of which 161 are owned and operated by La-Z-Boy and the rest are independently owned. The company also sells its products through the La-Z-Boy Comfort Studio locations, which are defined spaces within larger independent retailers that display and sell La-Z-boy branded products. This wholesale and retailer network allows the company to furniture retailers or distributors in the US, Canada, and approximately 55 other countries, including Australia, New Zealand, the United Kingdom, China, and South Korea, as well as selling directly to consumers through La-Z-Boy-owned stores and websites.

3. Financial and Stock Performance Analysis (2023 FY)

La-Z-Boy has increased its revenue by a compound rate of 6% within the last 10 years, going from $ 1.2 Billion to $ 2.3 Billion, almost doubling its revenue. The company’s net income margin has variated between 4% and 6% over the past 10 years. The cashflow from operating activities increased significantly from $ 79 Million in FY 2022 to $ 205 million in FY 2023, this was mainly due to changes in receivables, inventories and other assets due to the back log experienced and which decreased the free cashflow in FY 2022. Moreover, it is worth highlighting that the 10 year average Free Cash flow to Net income ratio is 108%, which reflects the company’s free cash flow has remained relatively similar to its net income.

Additionally, La-Z-Boy has a Debt to Free Cash flow ratio of 3.5, which means that by using its 5-year average Free Cashflow, LZB could pay all its debt in less than 4 years. This reflects La-Z-Boy strong capabilities to fund its acquisitions and capital expenditures to growth the business by using its free cash flow instead of relying on internal or external debt. This is an important aspect of the business given the current conditions of the market and the elevated cost of debt, where having a strong financial condition could sustain the operations of the company and even allow it to take advantage of arising opportunities.

Revenue Segment Analysis (2023 FY)

La-Z-Boy has three revenue segments, the wholesale segment, the retail segment, and the Corporate & Other segment. Let’s take a look at each one of them:

Wholesale: The wholesale segment produces and imports upholstered and casegoods furniture and sells it directly to La-Z-Boy Furniture Galleries stores, La-Z-Boy Comfort Studio® operators, England Custom Comfort Center operators, major dealers such as Berkshire Hathaway, Sofa Carpet Specialists, Slumberland Furnutire and Mathis brothers, as well as a diverse range of other independent retailers. For FY 2023, this segment decreased by 23% to $395 million as the backlog returned to pre-pandemic levels.

Retail: The retail revenue segment increased by 4% to $243 million but the delivered same-store sales remained relatively flat. This revenue segment is made up by La-Z-Boy Furniture Galleries stores that are owned and operated by the company, and it also includes sales from its websites.

Corporate & Other: This segment includes the shared costs for corporate functions such as HR, IT, Finance, and legal. This segment also includes the revenues from a global trading company in Hong Kong and the revenues from its Joybird Brand acquired in 2018, which manufactures upholstered furniture such as sofas, loveseats, chairs, ottomans, sleeper sofas, and beds. This revenue segment decreased 31% to $ 37 million as the market conditions tighten and the economic uncertainty impacted discretionary companies.

Shares outstanding

La-Z-Boy has decreased its shares outstanding by 20.37% to 43 Million since the last ten years. As per the Investor Presentation released on May 2023, the company will be focusing about 50% of its operating Cash Flow into the business and Return 50% to shareholders over the Long-Term through share repurchases and dividends.

4. Growth Drivers and Opportunities

La-Z-Boy’s denominated “Century Vision” Strategy is focused on strenghtening its direct-to-consumer approach through the acquisition of its independently-owned La-Z-Boy Furniture Galleries and opening new ones, this retail penetration strategy will boost the value offered to the customer by providing an end-to-end consumer experience and having a higher control of the quality of its operations, services and products.

The expansion of Joybird as an omnichannel strategy in which the company opens new small format urban showroms that aim to provide the customer a better feeling of what they are looking to acquire through Joybird’s website, is a well-known strategy used by key retailer companies such as Williams-Sonoma and Restoration Hardware. This will strengthen Joybird’s brand image and recognition in the market, as well as build more profitable and long-lasting customer relationships. In the earnings call for Q4 2023 and FY 2023, the company said they expect to open up to nine new stores during FY 2024 and continue to complete acquisitions of independent furniture gallery stores.

Additionally, it is worth noticing La-Z-Boy’s financial strenght as it carries little debt on its balance sheet and has plenty of highly liquid assets to cover the company’s financial obligations in the short term if a slowdown in the economy affects dramatically its revenue. Additionally, La-Z-Boy has 7.3 million shares available under its share repurchase authorization. This could represent a great opportunity for the company to invest in its business and increase its EPS if the company remains undervalued during the US uncertain economic situation in 2023.

5. Concerns and Threats for La-Z-Boy

The main concern for the furniture industry is the housing market and the overall economy as they belong to the discretionary items category. Although existing home sales rose 0.2% to a seasonally adjusted annual rate of 4.3 million units in May 2023. Home sales have dropped 20.4% on a year-on-year basis in May. Moreover, the outlook for the housing market remains uncertain as future hike rates are expected for FY 2023 and a higher pressure on mortgages and consumers purchasing power, will be reflected in lower discretionary spending.

Although La-Z-Boy’s “Century Vision” strategy will certainly improve the overall service and quality provided to the consumer in the long term, they are playing an aggressive expansion strategy in times when caution is needed. Its acquisition of independently owned stores may be executed at better prices in the current economy, but along with opening new stores, it could represent a burden for the company as this expansion will increase the fixed costs for the company and the revenue from this new stores could drag down the profitability and financial stability of the company in the short term.

Additionally, there is also a currency risk for La-Z-Boy that could impact the company higher than other retailers as La-Z-Boy pays wages and other local expenses from their Mexico manufacturing facilities with local currency. The expenses of the Canadian wholesale business and the manufacturing businesses in the United Kingdom are also paid in local currency, as well as the expenses of their venture businesses in Thailand. Therefore, a weakening of the dollar could significantly impact the company’s profitability as these operations are not handled in Us Dollars as other competitors do to mitigate the risk of currency exchange..

6. Valuation and Conclusion

La-Z-Boy stock is currently trading at a P/E of 7.90 and a Price to Free Cash Flow of 9.44, based on the last 5-year average free cash flow. Given the company’s retail penetration strategy, low debt, and century vision strategy, we believe La-Z-Boy is well-positioned for the long term. However, while the long-term perspective should be prioritized when estimating the value of a business, it is necessary to remain cautious and possibly demand a higher margin of safety given the current market environment and the impact that has already had on the home furnishing industry, which could provide for a better price in the short term. As a result, we believe the company’s fair value is less than $22, which we calculated using a conservative free cash flow analysis that takes into account the company’s potential short-term downturn.

Disclaimer

The information in this article and on our website does not constitute financial advice, investment advice, trading advice, or an offer to buy or sell any currency, product, or financial instrument. All information found here is purely for informational and educational purposes. You should not treat any opinion expressed by Unlazy Investing as a specific inducement to make a particular investment or to follow a particular strategy but only as an expression of opinion.