1. Summary

- The stock of RH, the leading luxury retailer in the home furnishing market, has dropped more than 65% from its all-time high price above $ 700, and it looks like it will keep falling.

- Tougher economic conditions will weaken the company’s performance as it operates highly on financial leverage with a 5.76 Debt-to-Equity Ratio

- RH’s initiative for expansion on new markets, which is the company’s ongoing strategy to increase revenue, will be highly impacted by the lack of financial stability and pullback in the strenght of the US Dollar, increasing thus the costs to open and operate its retail stores overseas.

2. Company Overview

Restoration Hardware (RH) is a luxury lifestyle retailer in the home furnishing market, where its brand is highly differentiated due to its stylish galleries, showrooms, and hospitality locations throughout the United States, Canada, and the U.K. The company has a total of 81 retail locations and it offers a wide portfolio of luxury furniture collections that they source mainly from artisans and specialty vendors. RH is focused exclusively on the high-end or wealthy consumers that they reach through their furniture “art” galleries, luxury guesthouses, restaurants, and wine bars, where all the furniture used to allow these deluxe experiences, can be purchased and therefore they serve the purpose of promoting RH products and inspiring its customers to take home the furniture they have already tried and seen firsthand.

Additionally, RH (NYSE: RH) has an RH Member program in which for an annual fee, the RH members get a set discount every day across the RH brand, excluding the hospitality and waterworks services and products. Besides the membership program, another main source of revenue for the RH luxury brand is its direct work and contracts with residential interior designers and decorators buying products for their clients’ residential projects for which RH provides large-scale products to furnish and decorate hotels, commercial properties, and single-family and multifamily units.

3. RH Financial Analysis

Revenue Growth: The revenue for the first quarter of 2023 was $739,162 million, down 29,51% from the $957,922 million in revenue for the first quarter of 2022. The company stated in its Q1 2023 Shareholders letter that they expect the luxury housing market to remain challenging during 2023 and 2024. Moreover, as per their revenue guidance for the fiscal year 2023, they expect to achieve revenue between $3.0 to $3.1, which will represent a Year-over-Year decline of almost 17%.

Profit Margin: Although the profit margin of RH has improved substantially during the past 5 years, increasing from 6,03% in 2018 to 14,74% in 2022, the outlook for the profit margin going forward could deteriorate significantly as their operating expenses to maintain and operate their physical retail stores as well as supporting the expansion plans of HR Guesthouses and Residencies, will be more challenging to control to maintain the company’s profitability.

ROE and ROIC. RH has a 10-year average ROE of 64,80% and its 10-year average ROIC is 8,6%. These metrics have improved outrageously since the past 5 years due to the company’s change in its real estate and store development model, which included replacing leasing stores for identifying capital partners and arranging sale/leaseback deals that decreased the overall capital expenditure involved in the expansion of the company to additional international markets such as the UK, France, Germany, Spain, Italy, and Belgium, for which they have signed agreements for opening design galleries.

Current Ratio/Liquidity: The company has a current ratio of 2,8%, which means that for every dollar of short-term financial obligations, they have 2,8 dollars to cover those obligations. However, this superior liquidity is not because of the economics of the business or retained earnings, this is due to a $2.0 billion Term Loan Credit Agreement that the company took on October 2021. Without the Loan obtained, the current ratio would have been 0.57, a huge difference that would have put the business under a lot of pressure to maintain its operations.

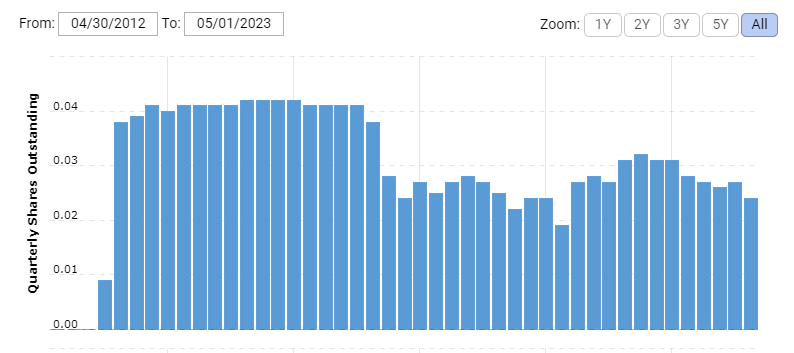

Stock Repurchase Program: As of January 2, 2023, the company has approximately $1,45 billion available for share repurchases. Although RH has repurchased its shares since 2016, it also has issued more shares. As of May 19, 2023, RH had 22,052,211 shares outstanding, which increased by 1,90% in comparison with the 21,634,290 shares outstanding as of June 8, 2018. So, in five years the company has not increased the stake of its shareholders, which is a key factor that great and well-managed businesses tend to do over time since it helps to compound its earnings per share.

Debt to Equity Ratio: Restoration Hardware has historically relied on the availability of debt financing as its main source of capital to fund its operations and strategic initiatives. The company has a Debt-to-Equity ratio of 5,76, signaling significant levels of financial leverage that affect the position of RH in an environment where the Federal Reserve Interest Rate is between 5% to 5.25% and it will likely continue to increase or stay high during 2023 and 2024. This has already affected the revenue of Restoration Hardware and it will continue to drag down its earnings as credit become scarce for developers, and sectors such as office rental have been falling due to the pandemic and the work-from-home trend, which increased vacancy rates to 19,1% for office properties in the first quarter of 2023, the highest since 1991.

Operating Expenses: The operating expenses have remained stable for the last 10 years, at an average rate of 29% as a percentage of revenue. That shows good control of their costs given the fact that they have been increasing their gallery openings pace through the years. So, it is interesting to see the company growing and expanding while maintaining its operational expenses under control.

4. Key Value Drivers and Strengths

The expansion of the company to new markets and new brands to be introduced such as RH Couture, RH Bespoke, and RH Color, is one of its key value-driving strategies that will increase its potential market share as it leverages its luxury brand image and reputation to offer more products and experiences to a broader within and outside of North America.

RH’s hospitality segment is well positioned and differentiated from its competitors as they provide luxury experiences for its customers and promote the same time its wide furniture portfolio, which serves an inspiration for customers to even buy the assortments or collections used in their hospitality locations, which is a segment that they plan to integrate into most of the new design galleries to be opened in the future.

The contract and trade segment gives Restoration Hardware a unique advantage as they leverage its luxury brand image to supply furniture to large commercial properties such as hotels and commercial development projects globally. It would be interesting for the company to report separately on this segment, but still, this is a long-term business segment that could enhance the growth of the company.

Additionally, the RH Members Program adds exclusivity to the brands and increases its customer loyalty, a key element for gaining market share and boosting the positioning of the brand. The members of this program drove approximately 97% of sales in the company’s core RH business, and there were approximately 351,000 members at the end of the year 2022.

5. Risks and Concerns

The significant decrease in the housing market and the credit tightening will have a serious impact on the company’s revenues in the short term. This along with the financial leverage of Restoration Hardware, weakens its position to maintain its profitability and to take advantage of the opportunities that a crisis in the housing market could represent, as they have incurred notable levels of indebtedness and it will be harder for them to get more debt or do it at reasonable rates.

Additionally, from a macro perspective, the decrease in the US Dollar value will represent higher costs for the company as they expect to expand into international markets despite the current market conditions. The change in the US Dollar value could also affect the relationship of Restoration Hardware with its suppliers as they do not have exclusive contract agreements, which could prevent those artisans and special retailers from providing their services and products to other retailers. That is the weakness associated with the RH business model as they do not manufacture the products they sell.

6. Valuation and Conclusion

The stock price has felt the pressure on Restoration Hardware’s business and it has dropped more than 65% from its all-time high price above $ 700. At the price of $ 244.64, RH is trading at a 12.43 P/E Ratio (TTM) and a Price to Free Cashflow of 18. Even though the PE ratio could seem low, the outlook for RH is highly uncertain and weak as they use significant financial leverage for their business operations, and that positions the company for an ugly performance in an economy where interest rates are increasing and spending on discretionary retail spending is dropping. The company has already seen a revenue contraction of 4.5 % in 2022 as its guidance for 2023 represents a further decrease of 17% in its revenue.

Therefore, we consider RH to be overvalued given its weak outlook and the pressure that a tough economy has had and will continue to have on RH’s high-leverage business operations in the luxury furniture retail industry. Moreover, the company lacks the geographical diversification that we consider highly valuable for the performance of great companies, and a downturn in the US Market, will crunch the company’s earnings and financial health significantly. We think there are better companies in the retail industry such as Williams-Sonoma, that have better business economics, stronger financial health, better diversified globally, and trading a lower valuation.

As a Final thought, there is no need to take the risk in RH and its failing business performance since there are plenty of opportunities in the market that could provide a better return in the long term and the risk/reward for investing in RH is not compelling enough to consider it as a good company to hold for the long term at the current price.

7. Disclaimer

The information in this article and on our website does not constitute financial advice, investment advice, trading advice, or an offer to buy or sell any currency, product, or financial instrument. All information found here is purely for informational and educational purposes. You should not treat any opinion expressed by Unlazy Investing as a specific inducement to make a particular investment or to follow a particular strategy but only as an expression of opinion.