1. Crocs Stock Analysis

We’ve previously discussed Croc’s valuation extensively, and it’s surprising how pessimistic the market values this well-known brand with best-in-class profits, mainly because even with a pessimistic outlook, Crocs stock offers still a good return at its current price of around $100. So, we will go over some of the concerns that influence this behaviour from Mr. Market. The first market’s concern stems from their misunderstanding of Crocs Inc. and the longevity of its good fortunes, viewing it (since 2019 primarily) as a FAD stock that sells hot products that will eventually go out of fashion or out of love in the market. The second source of concern is Crocs Inc.’s acquisition of HEYDUDE, which added a $2.5 billion financial burden to the company and has resulted in growth that has fallen short of the overly optimistic expectations placed on this newly acquired and underdeveloped brand.

Here’s our take on these two critical issues when analyzing Crocs stock:

- Crocs is a FAD: Crocs’ products have proven their worth as lightweight, comfortable, and durable shoes, which are now considered well-differentiated shoes (and even fashion shoes, according to some), which have even created a sort of cult following among its customers. And that is where we derive a different view of Croc’s long-term fundamentals. In Piper Sandler’s fall 2023 Taking Stock with Teens survey, Heydude was ranked seventh, and Crocs was the number six favorite footwear brand among U.S. teens, a position that it has held since 2021. In this latter report, which covers Crocs over the last few years, Crocs gained 30 bps of mindshare Y/Y and Heydude gained 50 bps. This reflects the strong positioning of the Crocs brand and the improving positioning of Heydude in the market.

Additionally, Crocs’ marketing playbook has demonstrated its ability to grow the brand by bringing newness and innovation through its collaborations with brands and artists. For example, in July, Crocs’ collaboration with Barbie, which featured clogs, sandals, and jibblitz, sold out quickly ahead of the movie launch, and a restock was needed during the quarter. Crocs’ new products, including the Echo Clogs, Crush, and Mega Crush clog styles, have also received similar recognition, contributing to the clogs category’s double-digit growth.

- HEYDUDE’s Concerns: Companies with poor capital allocations are hurt badly when it is clear that the management is destroying shareholder’s equity and these negative compounding actions are likely to happen again in the future. However, when it comes to Crocs’ Heydude acquisition, even though revenues are expected to decrease 4% in FY 2023 compared to Heydude’s revenues for the period before the acquisition closed in 2022, brand awareness has increased from 18% to 32%, and it has not been a bad acquisition.

Here’s the quick math behind Crocs’ Heydude acquisition. Crocs paid 2.5 billion for Heydude, a brand that will generate approximately $949 million in revenue in FY 2023, with a Non-GAAP operating margin of 20.1% (excluding expansion, duplicate rent, and transitional storage costs). HEYDUDE’s current valuation, assuming no revenue growth or further decline, is sitting at around 12.8 times price to earnings. So, make no mistake in evaluating Croc’s acquisition without considering the current and potential value that HEYDUDE brings to Crocs.

As per the latest Q3 FY 2023 earnings call, the management has outlined the improvement of HEYDUDE’s gross margins now that the integration costs represented on improving the warehouse capabilities, the implementation of an ERP system to improve efficiency across the brands, and the openning of Heydude’s distribution center in Las Vegas, have layout the ground for boosting healthy growth in Heydude Brand, which has been tested on a few markets in the US and Europe, and it is expected to expand in new international markets in the next two to three years.

Therefore, HEYDUDE’s revenues and its sustained free cashflow represent a value acquisition for Crocs, and it provides them with a significant growth opportunity as Crocs gets to use its distribution network and brand position on the market to improve HEYDUDE’s margins and expand it to new markets using Crocs’ tested and effective marketing playbook. So, the downside has been addressed (and currently priced), and the potential upside is underway.

2. Five Reasons why we consider Crocs stock as a value investment

1. Crocs Brand and Growth Potential

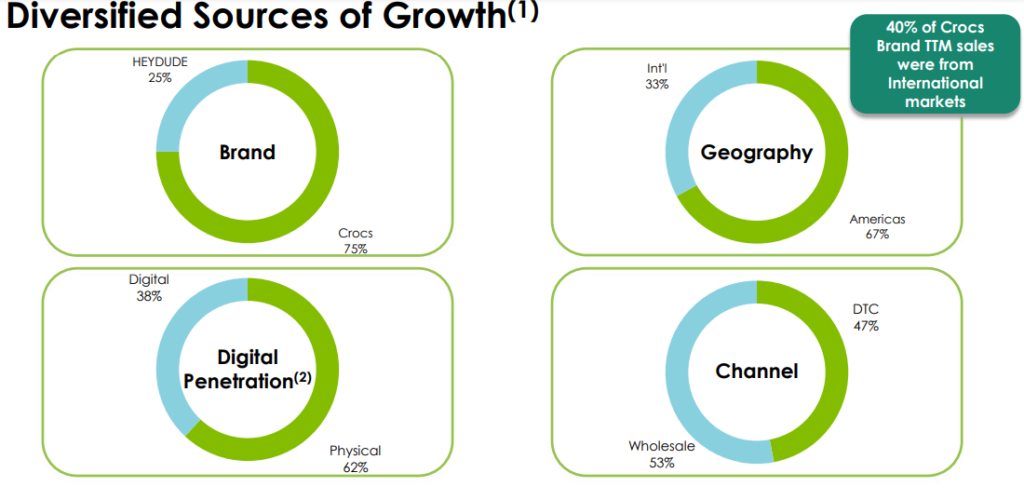

Crocs is a well-known brand with relevance in the global market thanks to its reliable casual footwear that is both comfortable and easy to wear on and off. And, although it is easy to categorize Crocs Inc. as a value trap due to its turnaround since 2016 and the tailwind that Crocs experienced due to the pandemic and the increasing demand that it spurred for comfortable shoes at home, the facts now reflect a stronger, well positioned, long-term minded brand with high profitability margins, that is growing rapidly in the Americas, EMELALA, and particularly in Asia, where it grew revenues by 29% in the Q3 FY2023, and by 90% in China alone.

Additionally, Croc’s successful marketing playbook of driving momentum and newness into the brand by collaborating with artists and influencers enables Crocs to enjoy a healthy turnover on its classic products, especially on its special limited-edition collections. And this value evolves around a market that values high comfortability, durability, and a wide range of options and styles inspired by customers’ favorite artists and brands. So, as long as three key aspects surrounding Crocs, are valuable for the market (which we consider will remain an important part of the footwear market for years to come), Crocs will enjoy a favorable position in a $305B Non-Athletic Footwear Market, which includes a $30 billion market for sandals alone.

2. Diversified Portfolio

A key aspect that reflects the strength of brands in the market is their ability to introduce new products across different categories with success, especially when these products are aligned with the company’s core values and already winning products. Crocs has successfully approached this strategy to strengthen and diversify the products it offers, which now include clogs, boots, sandals, platform wedges, flats, slippers, slides, flip-flops, and socks. These provide an interesting opportunity for Crocs to leverage its brand value to reach new markets and increase the number of pairs and products that each customer buys from Crocs

3. Geographical Diversification

4. Crocs Management Quality

Crocs products are sold in more than 85 countries, and its brand is growing rapidly in Asia and EMEALA. This enables Crocs to withstand country-specific risks like the potential recession in the United States or Europe (and pretty much globally), which means that Crocs will continue generating a decent level of cash flows and continue implementing its value creation strategies for deepening the position of the brand globally, which is on the ground already, as Crocs is set to expand HEYDUDE into new international markets, starting in the US and Europe, in the next two to three years.

A long-term perspective and strategy about the business are crucial for ensuring the prosperity and profitability of the brands, and Crocs has that focus nailed nicely. This mindset is reflected both in Crocs’ actions, its strategy going forward, and commentary from the management on its different reports and communications. For example, Heydude’s non-strategy accounts were reduced by over 50% in 2023 to promote brand health in the long term, which shows an interesting management behavior and mindset that prioritizes the sustained growth of the company even when that means giving up short-term revenue.

Another strategy that reflects Crocs’ commitment to prioritize long-term market health is the company’s decision to stop price matching with the gray market goods that are selling on Amazon, which represents a short-term headwind for the company as it puts pressure on sales. But in the long term, the company’s strategy for reducing non-strategic accounts will reduce the leak of Crocs’ products sold on Amazon at steep discounts from the market and will ultimately affect Crocs’ margins positively. Moreover, Crocs management has stated on several occasions, and at the Crocs’ presentation at the ICR Conference 2024, Anne Mehlman, Crocs CFO, mentioned in the Crocs preliminary 2024 outlook that the improvements from the operating margins (of 25%) will be invested into SG&A to support Crocs long-term future growth, reflecting thus again Crocs management long-term mindset.

5. Crocs Stock Valuation

Currently trading at $100,81, with a 9.25 price-to-earnings ratio, Crocs offers an attractive long-term buying opportunity with a reasonable return above 15%, given the fact that the company is expected to grow between 3% to 5% in FY 2024, and the impact that its growing and well-recognized business, as well as the impact of Crocs’ strategies for improving and expanding the distribution of Heydude, will have on the company’s free cash flow, now sitting at 6.67 price-to-free cash flow, which provides a significant margin of safety for a company with a globally diversified and reliable source of free cash flow, that will be reinvested (after lowering its debt down and repurchasing its shares) at high-profit margins (25%-27%) with a long run ahead given the strong brand positioning on the customer’s mind and the growth momentum on markets such as Asia and EMEALA.

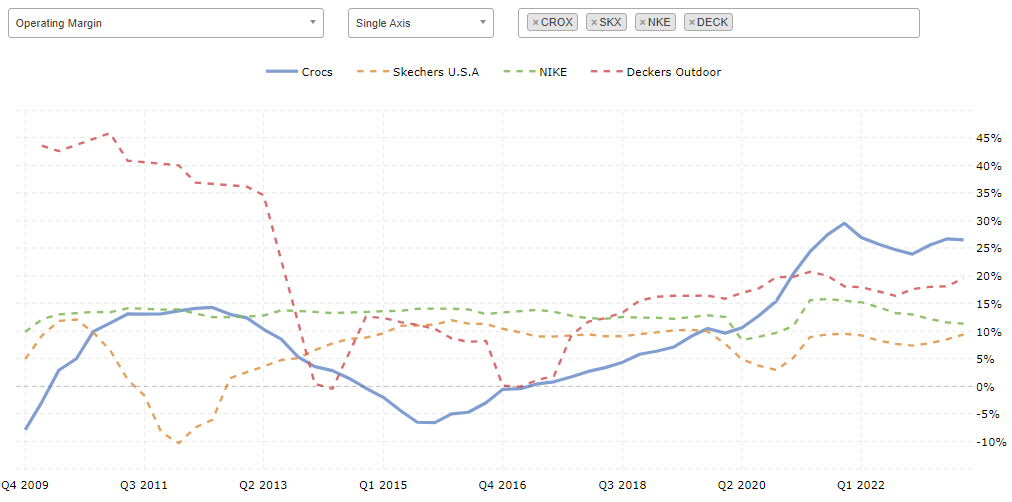

So, even though many investors see Crocs on the path to reversion to the mean (Crocs profits were mostly negative from 2013 to 2018), the customers’ love for the brand and its management execution point towards a strengthening position that will yield a long-term value creation driven also by the benefits that scale provides, for which the management has emphasized its strategy for reinvesting additional improvements in profitability to support Crocs long-term growth.

Disclaimer

The information in this article and on our website does not constitute financial advice, investment advice, trading advice, or an offer to buy or sell any currency, product, or financial instrument. All information found here is purely for informational and educational purposes. You should not treat any opinion expressed by Unlazy Investing as a specific inducement to make a particular investment or to follow a particular strategy, but only as an expression of opinion.