1. Consolidated Results: Q2 2023 vs Q2 2022

Williams-Sonoma’s comparable brand revenue decreased by 11.9% amidst a challenging environment for the home goods industry, where many are seeing steep declines or even facing bankruptcy. WSM has experienced significant pressure on high-end tickets, especially in the furniture segment.

Gross margin decreased 280 basis points to 40.7% due to higher shipping and freight costs. The operating margin decreased 250 basis points to 14.6%, compared to 17.1% in Q2 2022. However, SG&A decreased slightly to 26.1% compared to the last period’s 26.4%, reflecting the company’s decision and measures to rightsize the organization to control costs and drive efficiency. Diluted earnings per share decreased 19% to $3,12 compared to the $3,87 reported for Q1 FY 2022.

The net cash provided by operating decreased 31% to $358 million compared to $521 million in Q2 FY 2022. The company paid $58 million in quarterly dividends and repurchased 300 million, or 3.8%, of shares outstanding, and it ended the quarter with a cash balance of $297 million with no debt outstanding.

2. Brands’ Revenue and Performance

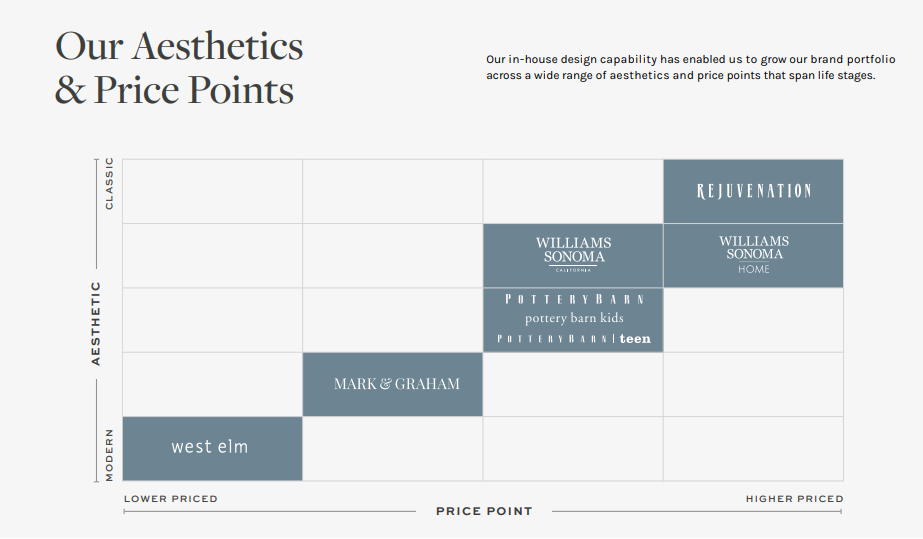

Williams-Sonoma reports revenues in five different segments, which include Pottery Barn, West Elm, Williams-Sonoma, Pottery Barn Kids and Teen, and Other. We will cover some of these segments specifically and also some new initiatives and businesses in which the company is investing to extend and strengthen its market share by deleveraging its competitive advantages and value proposition.

Pottery Barn

The revenue on Williams-Sonoma’s strongest brand decreased by 10.6% compared to last year as the demand for furniture is experiencing a softening, which is expected to continue in the quarters to come. However, there are segments within Pottery Barn that are experiencing relative strength in decorating: frames, pillows, rows, and table linens. As commented on the recent earnings call for Q1 FY 2023, WSM is on its way to expanding Pottery Barn in India, where they plan to open three new stores next month, including the first Pottery Barn Kids Store.

To boost the growth and penetration of Pottery Barn, the company is focused on strategically relocating its stores. In Q2, they opened a newly relocated store on Post Road in Westport. As per the comments from Williams-Sonoma CEO Laura Alber, this relocation has been successful and reflects the effectiveness of Williams-Sonoma’s retail optimization strategy. Pottery Barn is also reaching new opportunities, such as the underserved dorm market for college-bound students, which the company expects to continue to take market share and drive year-over-year double-digit growth.

West Elm

West Elm revenues were the most impacted in this second quarter across the different Williams Sonoma’s brands, with a 20.8% revenue decline, as this brand has the highest percentage of its assortment in furniture and is focused on medium-priced items, which rank as the lower price point of Williams Sonoma’s brand portfolio. As per the comments made by the WSM CEO on the earnings call, they expect West Elm to expand into textiles, decorative accessories, entertainment, and seasonal offerings to increase the penetration of the brand.

Williams-Sonoma

The Williams-Sonoma brand was the strongest in the second quarter, with a revenue decline of 0.7%. The revenue was driven mainly by the kitchen business and high-end electric items, particularly coffee and espresso. The company expects the holiday entertaining and dining-at-home businesses to drive strong results for the brand.

Business to Business

The revenues in this segment declined by 5% in the second quarter, which impacted trade business due to the slowed housing market. However, its contract business section revenues grew 23% in the quarter, in which the company won several proposals, including Sony in the entertainment space, the San Antonio Spur’s training facility, and multiple properties with the Montage, the Four Seasons, Westin, Hilton, and Hyatt, as per the comments in the Q2 earnings call.

Global Business

The company has seen strong momentum in the Indian market, where WSM is opening its third West Elm store, its second Pottery Barn store, and, as we mentioned previously, its first Pottery Barn Kids store in Q3 2023. India has recently caught the attention of many companies due to its recent economic and population growth. For the furniture industry, it is also an attractive market. The furniture market size in 2022 was valued at USD 23.12 billion, and it is expected to grow at a CAGR of 10.9% between 2023 and 2028.

Additionally, WSM is also expanding into the Middle East with the opening of an additional Pottery Barn and West Elm store in Saudi Arabia in Q2. In Canada, the B2B segment was launched in Q1, and WSM is expecting to introduce Canadian customers to Rejuvenation, Mark and Graham, and Williams Sonoma Home with the launch of their websites in 2023.

Emerging Brands

In the first half of 2023, Williams-Sonoma launched its new brand, GreenRow, which specializes in providing vintage-inspired heirloom-quality products by using completely sustainable materials and manufacturing practices. GreenRow’s assortment includes living, bedroom, and dining furniture as well as rugs, bedding, bath, baby, lighting, pillows, throws, curtains, table linens, dinnerware, and decor.

3. Outlook and Considerations

WSM lowered its guidance for FY 2023 to reflect the slowdown trends in the industry and their notable impact on the furniture segment. The company now expects a revenue decline in the range of -5% to -10%. The operating margin guidance was raised by 100 basis points, and it is expected to be between 15% and 16%.

We consider Williams-Sonoma to be well positioned for a downturn period given its broad portfolio in terms of categories and products, as well as in terms of pricing and geographical diversification, which is a crucial point when evaluating the company’s prospects as its business model is built on its in-house design capabilities, the development of new products and brands, and direct-to-customer services boosted by a solid vertically integrated organization. This is reflected in the company’s abilities to create and introduce new brands as well as extend its presence in new markets globally while maintaining overall industry-leading profitability.

4. Disclaimer

The information in this article and on our website does not constitute financial advice, investment advice, trading advice, or an offer to buy or sell any currency, product, or financial instrument. All information found here is purely for informational and educational purposes. You should not treat any opinion expressed by Unlazy Investing as a specific inducement to make a particular investment or to follow a particular strategy, but only as an expression of opinion.